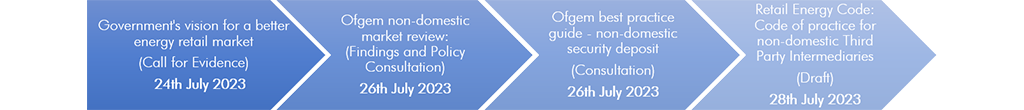

TPI Regulation, ADR expansion and commission disclosure

Currently, TPIs are not regulated. Whilst Ofgem does have limited powers under the existing Business Protection from Misleading Marketing Regulations, its ability to regulate a diverse market is somewhat limited. The energy regulator does accept that advances have been made to tackle the ‘sharp practices’ of a minority of TPIs following the reforms introduced through the Micro Business Strategic Review (2022), however, Ofgem has now taken the bold step and asked the Government directly for more ‘formal regulation of the TPI market’. There is little in terms of detail here, although it is seen that such major reform would go in-hand with changes to the scope of the TPI Alternative Dispute Resolution (ADR) scheme.

Since 1st December 2022 it has been a requirement of a supplier’s license to only work with TPIs who are party to a qualifying ADR scheme where they have Micro Business customers. This ADR scheme exists to support Micro Business customers resolving disputes with TPIs and effectively safeguards them as a vulnerable group.

As part of its review, Ofgem are consulting on extending the energy brokers ADR scheme to include other businesses that operate at a different scale outside the current Micro Business definition. And while the specifics of the eligible scope of businesses remains unclear, there are a few ways Ofgem is considering implementing this change:

- Require ALL non-domestic TPIs to sign up to a Qualifying Dispute Settlement Scheme. Ofgem notes that this is the most expensive option, although it would mean that more customers would be able to access such a scheme, with issues dealt with in a more effective and timely manner across the market.

- Require SOME additional TPIs to sign up to a Qualifying Dispute Settlement Scheme. In this case ‘some’ refers to any broker interacting with businesses that are not large businesses (a threshold which the consultation wishes to explore with stakeholders for determination).

The option chosen will shape the future supply license conditions in terms of who a supplier works with. Linking to this is a separate proposal that requires suppliers to disclose their commission fees to all customers, not just micro business. The reasoning behind this move is to enhance transparency and enable customers to make more informed decisions when selecting a supplier, as they would have a comprehensive understanding of all associated costs. How this information is presented on the Principal Terms is subject to consultation responses.

Extending non-domestic protections beyond the Micro Business

The February 2023 Call for Evidence provided the regulator with the information to recognise the challenges faced by Non-Micro Business customers, especially in resolving disputes with suppliers where the only practical remedy is one provided through legal channels. This is often a non-starter for many larger businesses operating on tight margins.

To tackle this area Ofgem are consulting on the following.

First, Ofgem proposes that Government should broaden the existing complaints regulatory framework to include more non-domestic consumers. Again, the extent to this protection is subject to determination. The consequence of this amend is that the scope of the Energy Ombudsman (EO) would also need to change, enabling access for Non-Micro Business customers.

Second, similar to the ADR changes, the actual threshold for referring Non-Micro Business customers to the EO is not known, with the consultation discussing the pros and cons of an ‘all in’ or ‘limited’ approach. To determine who should be granted wider access, Ofgem seeks stakeholder input on whether they should set limits or allow businesses to decide if an ADR scheme is the best option for their circumstances, essentially allowing a natural threshold to occur.

Security Deposit management

To address market concerns of how suppliers calculate, communicate and service security deposits, Ofgem has developed and introduced a best practice guide, which aims to uphold the principles of transparency, consistency and fairness. Overall, this guidance seeks to address issues stemming from a lack of transparency and unclear expectations surrounding security deposits. By following this best practice, the need for new supply licence rules can be avoided, preventing potential restrictions on customers’ supply choices.

The key guidance headlines are as follows:

Assessing a customer’s creditworthiness

Suppliers should communicate how they assess creditworthiness to non-domestic customers including estimated timeframes for the assessment, calculation methodologies, and results

Requesting a security deposit

Security deposit requests must be in writing, clearly setting out the reason(s) for the deposit, its basis and level, repayment timeline and any alternative options to reduce credit risk

Re-evaluating security deposits

Best practice dictates that if there is potential for reevaluating security deposits, customers should receive partial or full refunds if their creditworthiness improves, thereby reducing the supplier’s risk. Suppliers have the discretion to choose whether to reevaluate and a customer’s request does not automatically mandate it

Holding and managing security deposits

Suppliers must adhere to the financial responsibility principle (SLC 4B) and be able to return it back within a reasonable timeframe, setting a clear pathway for the consumer

Pricing of deemed contracts

Ofgem regulate deemed contract rates because customers in such a situation have not proactively chosen the supplier and given that there is no formal contract, they can be potentially vulnerable should they take such energy. The most common reason for customers being charged deemed rates is as a result of a Change of Tenancy (CoT). Ofgem heard that some TPIs had concerns that some suppliers were purposely obstructing the CoT process in order to keep customers on higher rates for longer.

The Consultation summarised that being on deemed rates can be a vicious cycle for customers as they will be put on higher deemed rates, which they may not be able to pay and so end up in debt. For suppliers, such customers are an unknown certainty, with energy purchasing becoming riskier due to unknown consumption requirements as well as a fear that a customer may not pay (the credit risk). Ofgem found that some suppliers were over-compensating for these high costs, meaning that they were causing the number of customers with bad debt to increase at a time when customers were already facing wider economic hardships. Ofgem were clear that some suppliers can expect enforcement action.

To avoid all the negative consequences of customers being on deemed contracts, Ofgem is looking to publish a new version of its Deemed Contract Guidance and is recommending that suppliers review their deemed rates on a quarterly basis – any more often would be too unpredictable for customers and any less may not accurately reflect the changing cost elements.

Streamlining the processing of CoTs

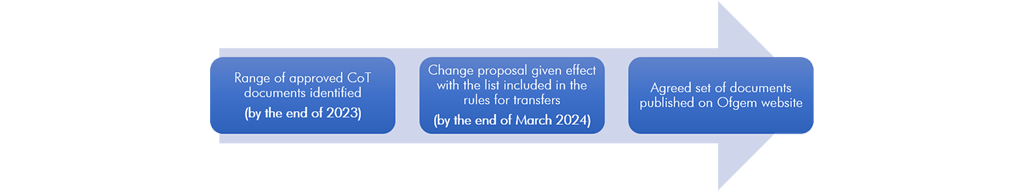

The most common reason for customers paying deemed rates for prolonged periods of time is due to CoTs. Ofgem found that there was no universal approach adopted by suppliers in processing a CoT, with different suppliers requiring different documents, with some documents being more onerous than others in terms of availability, it meant that some new tenants were subjected to deemed rates for many months until such documentation was presented. It was also reported that some new CoT customers have simply paid off the debt of the previous tenant just to move the CoT process along.

Proving that a genuine CoT is taking place is also another difficulty suppliers face when trying to handle a CoT request. Due to the scaling back of Government support schemes and volatile prices (especially during the winter of 2022/23), suppliers have reportedly seen an increase in fraudulent CoT applications.

The solution? Ofgem have tasked the REC with making the CoT process more consistent across the market, creating a universal set of ‘approved’ CoT documents that can be used by suppliers.

My Account

My Account  My Account

My Account